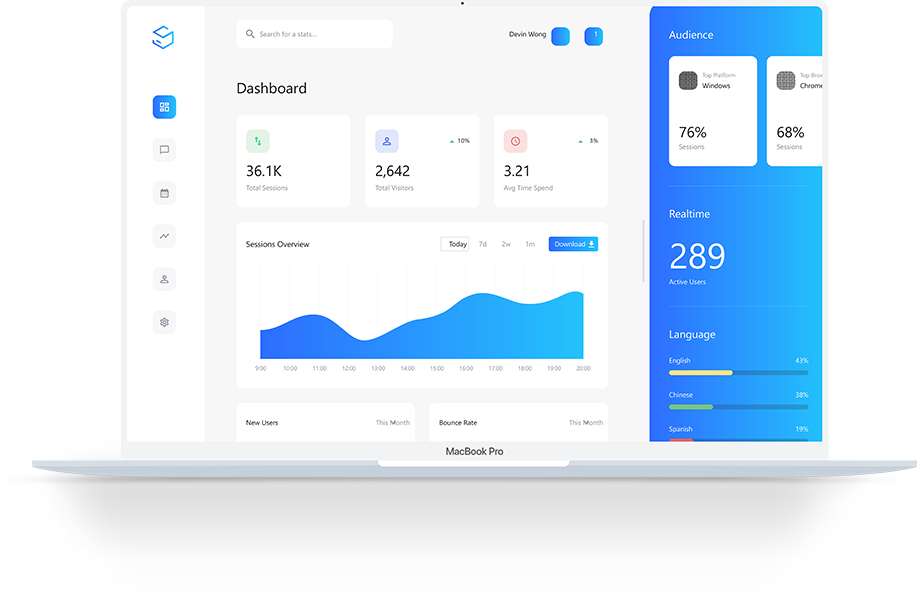

Digital Assets Marketplace with full life cycle solutions for Capital Markets

Powering a democratized and decentralized marketplace with privacy

Introduction

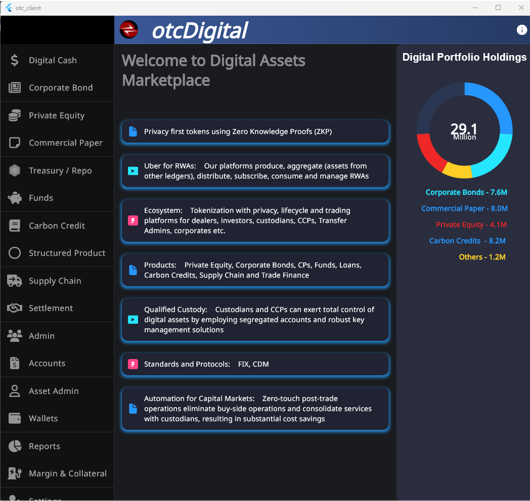

otcDigital has developed a privacy-first institutional digital asset marketplace designed to address real-world assets (RWA) in capital markets. The marketplace ecosystem integrates diverse asset classes, trade lifecycle management processes, digital gateways bridging TradFi and crypto markets, and trading platforms tailored for investors, dealers, custodians, transfer agents (TAs), and central counterparties (CCPs).

Participants in the marketplace can operate independently while interacting seamlessly through privacy-first ledgers. By leveraging a decentralized infrastructure, the platform democratizes access to digital assets, enabling peer-to-peer (P2P) trading and real-time on-chain settlements.

otcDigital has built a comprehensive decentralized real-world asset (RWA) marketplace that includes:

- On-chain privacy for transactions and cap-table/inventory management on a Layer 1 ledger

- Full privacy for primary market distribution and secondary market trading among participants, enabled through a set of Layer 2 ledgers

- Asset coverage spanning cash, treasury and repos, corporate bonds, private equity, wrapped regulatory compliant cryptos, commercial paper, carbon credits and more

- Tailored full-stack Web3 platforms designed for investors, dealers, custodians, and transfer agents

otcDigital for Issuers

Enables direct interaction with Buy-side for trading and execution without any intermediaries:

- Issue, Mint, distribute, trade and settle security tokens with full life cycle support

- Offer digital cash and lending solutions to clients

- Provide execution to your clients with Digital RFQ & OMS

- Access to digital market infrastructure – exchanges, other asset networks

- Full support for Stablecoins, CBDC, STOs and other private and public tokens

- Full API support for all functions

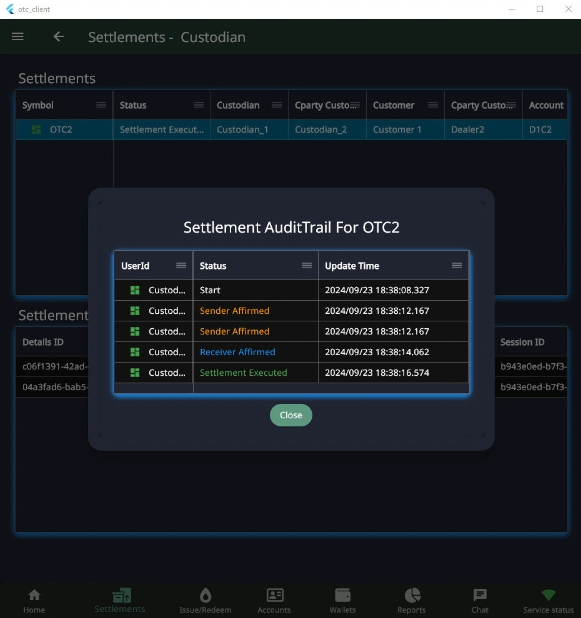

otcDigital for Custodians

Integrated and secure custody platform enabling session based and on-demand settlement of digital assets:

- Secure MPC based Custody

- Integrated with buy-side and dealer platforms using distributed ledgers to enable real-time payments (P), deliveries (D), DvP and PvP

- Support for RTGS, Netting & settlement

- Full segregated custody support for RWAs

- Seamless integration with custodian’s cold and warm vaults

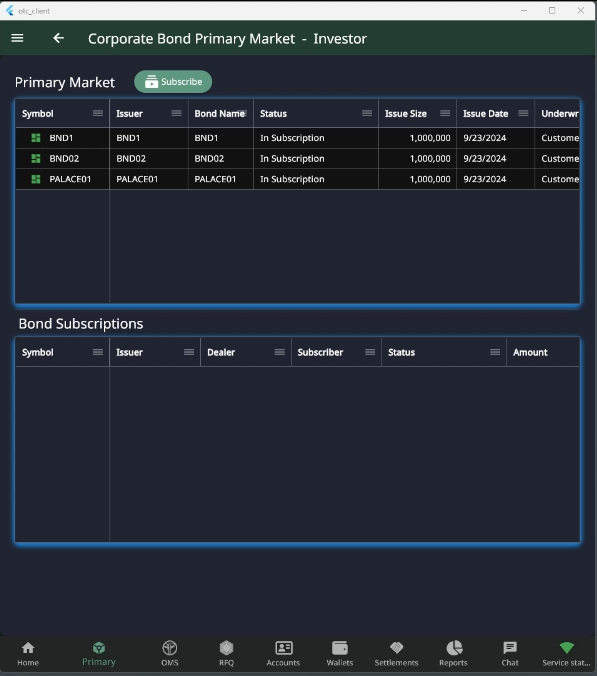

otcDigital for Investors

Enables direct interaction with dealers for trading and execution without any intermediaries:

- Full digital trade life cycle support from execution, allocation, netting and session based settlement

- Execute trades with dealers using built-in Digital RFQ & OMS

- Access to digital market infrastructure – exchanges and other asset networks

- Full support for Stablecoins, RWAs and cryptos

- Integrated with Dealer and Custody platforms using layer 2 privacy ledgers

otcDerivatives

It is the first cloud-based platform to allow financial participants the ability to optimize their Initial Margin (IM) and collateral deployment across a wide range of OTC trade types.

- Best Clearing: optimal clearing path for a portfolio based on IM, credit and collateral

- Best Execution: SEF aggregation, execution using RFQ/CLOB

- Best Collateral: margin call aggregation, collateral pool and management tool